![]()

![]() Over last week, the total number of deaths caused by coronavirus in China has reached 636 and the number of confirmed cases has reached 31,161.

Over last week, the total number of deaths caused by coronavirus in China has reached 636 and the number of confirmed cases has reached 31,161.

![]() OPEC+ held a three-day meeting from Monday February 3, to discuss the possible oil output cuts in response to the declining demand from China where many cities are quarantined due to the coronavirus outbreak. The cuts have not been agreed yet as Russia claimed that it will need more time to assess the impact on the oil market.

OPEC+ held a three-day meeting from Monday February 3, to discuss the possible oil output cuts in response to the declining demand from China where many cities are quarantined due to the coronavirus outbreak. The cuts have not been agreed yet as Russia claimed that it will need more time to assess the impact on the oil market.

![]() On Thursday February 6, China announced further reductions of tariffs imposed on $75 billion of American goods, taking effect from February 14. The tariffs will be halved from 10% to 5%.

On Thursday February 6, China announced further reductions of tariffs imposed on $75 billion of American goods, taking effect from February 14. The tariffs will be halved from 10% to 5%.

![]() On Friday February 7, the CEO of Credit Suisse Tidjane Thiam, who had been involved and investigated in two spying scandals, decided to step down from his position on February 14. Thomas Gottstein has been named as the new CEO of the bank.

On Friday February 7, the CEO of Credit Suisse Tidjane Thiam, who had been involved and investigated in two spying scandals, decided to step down from his position on February 14. Thomas Gottstein has been named as the new CEO of the bank.

![]()

![]()

![]() On Monday February 10, China CPI for January will also be announced, with an expectation of 4.90% YoY.

On Monday February 10, China CPI for January will also be announced, with an expectation of 4.90% YoY.

![]() UK GDP growth will also be released on Tuesday February 11, at an expected rate of 1.0% YoY.

UK GDP growth will also be released on Tuesday February 11, at an expected rate of 1.0% YoY.

![]()

+0.62*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/01/2020

Notice:

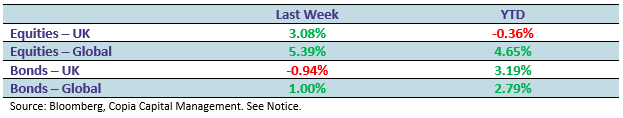

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.