![]()

![]() On Monday August 12, Argentina currency, together with stocks and bonds, dropped sharply. Peso was down over 30% to a record low of 60 per US dollar as the President Mauricio Macri unexpectedly suffered a defeat in primary elections with a wide margin on Sunday August 11.

On Monday August 12, Argentina currency, together with stocks and bonds, dropped sharply. Peso was down over 30% to a record low of 60 per US dollar as the President Mauricio Macri unexpectedly suffered a defeat in primary elections with a wide margin on Sunday August 11.

![]() On Tuesday August 13, the US decided to delay the introduction of the additional 10% tariff on Chinese goods like mobile phones, laptops etc. from September 1 to December 15. The US will go ahead with applying 10% additional tariffs on a number of other items as initially planned.

On Tuesday August 13, the US decided to delay the introduction of the additional 10% tariff on Chinese goods like mobile phones, laptops etc. from September 1 to December 15. The US will go ahead with applying 10% additional tariffs on a number of other items as initially planned.

![]() On Wednesday August 14, the US yield curve inverted with the spread between 10-year and 2-year Treasury yields turning negative and on Thursday August 15, the 30-year bond yield fell below 2% for the first time, signalling a forthcoming recession. The US Fed is now expected to cut interest rate by another 0.25% in September meeting.

On Wednesday August 14, the US yield curve inverted with the spread between 10-year and 2-year Treasury yields turning negative and on Thursday August 15, the 30-year bond yield fell below 2% for the first time, signalling a forthcoming recession. The US Fed is now expected to cut interest rate by another 0.25% in September meeting.

![]() On Thursday, Alibaba Group reported Q2 earnings, showing a jump in earnings per share of 146.3% YoY and the revenue topped the estimates, growing to $16.74 billion, 42% higher than the same period last year.

On Thursday, Alibaba Group reported Q2 earnings, showing a jump in earnings per share of 146.3% YoY and the revenue topped the estimates, growing to $16.74 billion, 42% higher than the same period last year.

![]()

![]()

![]() Eurozone CPI for July will be announced on Monday August 19, with an expectation of 1.1% YoY.

Eurozone CPI for July will be announced on Monday August 19, with an expectation of 1.1% YoY.

![]() On Friday August 23, Japan CPI for July will also be published with an expectation of 0.5% YoY.

On Friday August 23, Japan CPI for July will also be published with an expectation of 0.5% YoY.

![]()

+0.49*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/07/19

Notice:

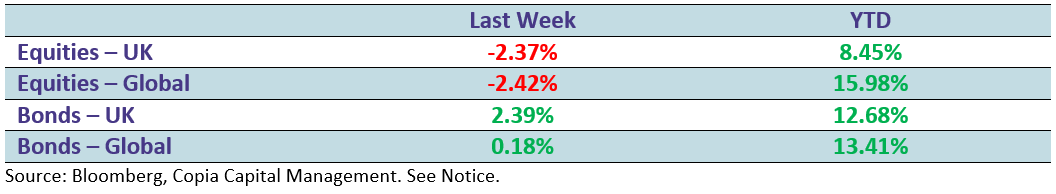

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.