![]()

![]() On Sunday July 7, Deutsche Bank announced a restructuring plan of a €7.4B overhaul, which includes cutting 18,000 jobs, exiting global equities businesses and suspending dividend payment over the next two years.

On Sunday July 7, Deutsche Bank announced a restructuring plan of a €7.4B overhaul, which includes cutting 18,000 jobs, exiting global equities businesses and suspending dividend payment over the next two years.

![]() On Wednesday July 10, the US Fed chairman Jerome Powell hinted a rate cut in July, and expressed his concerns over the impact of the trade war and the global economic slowdown in his testimony to the House Financial Services Committee. Markets now expect the US interest rate to decrease to 2%-2.25%.

On Wednesday July 10, the US Fed chairman Jerome Powell hinted a rate cut in July, and expressed his concerns over the impact of the trade war and the global economic slowdown in his testimony to the House Financial Services Committee. Markets now expect the US interest rate to decrease to 2%-2.25%.

![]() Also on Wednesday, the European Commission lowered the GDP growth forecast of the euro-area from 1.5% to 1.4% for 2020, also citing the uncertainties of the trade tensions between the US and China.

Also on Wednesday, the European Commission lowered the GDP growth forecast of the euro-area from 1.5% to 1.4% for 2020, also citing the uncertainties of the trade tensions between the US and China.

![]() Bitcoin fell back to $11,000 on Wednesday from its $13,000 mark, after gaining 70% in a month. The drop was following Powell criticising Facebook’s digital currency Libra for raising a lot of reasonably concerns.

Bitcoin fell back to $11,000 on Wednesday from its $13,000 mark, after gaining 70% in a month. The drop was following Powell criticising Facebook’s digital currency Libra for raising a lot of reasonably concerns.

![]()

![]()

![]() China GDP growth will be released on Monday July 15, at an expected growth rate of 6.2% YoY.

China GDP growth will be released on Monday July 15, at an expected growth rate of 6.2% YoY.

![]() UK CPI for June will be announced on Wednesday July 17, with an expectation of 2.0% YoY.

UK CPI for June will be announced on Wednesday July 17, with an expectation of 2.0% YoY.

![]()

+0.33*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 01/07/19

Notice:

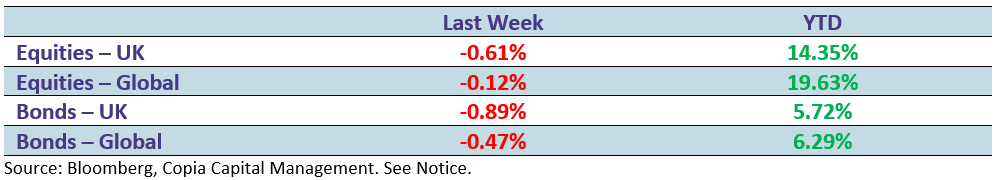

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.