![]()

![]() A selloff started in equity markets from Tuesday December 4 driven by investors’ concerns about US-China trade war and signs of recession. On Thursday December 6, markets plunged again following the arrest of Huawei’s CFO in Canada, who is alleged to have violated US sanctions against Iran according to the US.

A selloff started in equity markets from Tuesday December 4 driven by investors’ concerns about US-China trade war and signs of recession. On Thursday December 6, markets plunged again following the arrest of Huawei’s CFO in Canada, who is alleged to have violated US sanctions against Iran according to the US.

![]() On Wednesday December 5, the Scottish parliament voted to formally reject Theresa May’s withdrawal deal on Brexit while no alternative plan was agreed.

On Wednesday December 5, the Scottish parliament voted to formally reject Theresa May’s withdrawal deal on Brexit while no alternative plan was agreed.

![]() On Thursday December 6, China confirmed that the US and China “reached a high level of consensus” during G20 summit, with both sides agreeing to pause the trade war by holding back new actions imposed on each other for 90 days in order to negotiate new trade deal.

On Thursday December 6, China confirmed that the US and China “reached a high level of consensus” during G20 summit, with both sides agreeing to pause the trade war by holding back new actions imposed on each other for 90 days in order to negotiate new trade deal.

![]() OPEC announced an agreement on Thursday to cap oil production with Saudi, proposing to cut output by 1 million barrel per day which however, still awaits agreement from Russia and other major oil producers.

OPEC announced an agreement on Thursday to cap oil production with Saudi, proposing to cut output by 1 million barrel per day which however, still awaits agreement from Russia and other major oil producers.

![]()

![]()

![]() The UK trade balance for October will be announced on Monday December 10, with an expected deficit of £1.1bn.

The UK trade balance for October will be announced on Monday December 10, with an expected deficit of £1.1bn.

![]() US CPI will be released on Wednesday December 12 and is expected to come in at 2.2% YoY.

US CPI will be released on Wednesday December 12 and is expected to come in at 2.2% YoY.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/11/2018

Notice:

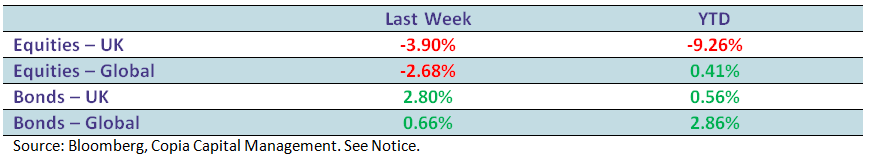

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.